|

|

|

|---|

|

|

|

|---|

|

|

|---|---|

|

|

|

|

|

|

|

|---|

Run Your Credit Score: Understanding and Managing Your Financial Health

Running your credit score is an essential step in managing your financial health. It helps you understand where you stand in the eyes of lenders and guides you in making informed financial decisions.

Why You Should Run Your Credit Score

Regularly checking your credit score can alert you to potential issues and help you improve your creditworthiness. Here are some reasons why you should consider running your credit score:

- Detect Errors Early: Mistakes on your credit report can negatively affect your score.

- Prevent Identity Theft: Monitoring your credit helps catch unauthorized activity.

- Plan Financial Goals: Knowing your score aids in setting realistic financial objectives.

How to Run Your Credit Score

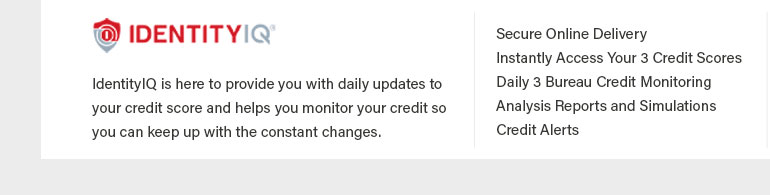

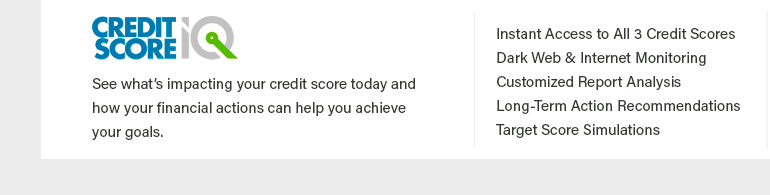

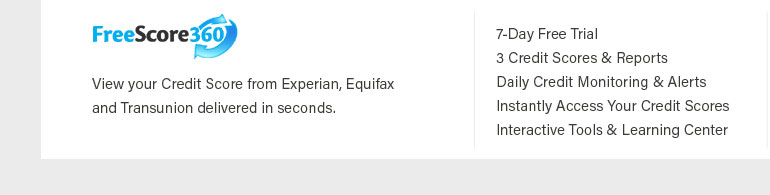

There are various ways to check your credit score. You can run a credit check through different platforms that offer this service.

Using Free Services

Many online services provide free credit scores. These platforms usually require you to create an account, but they offer valuable insights without any charges.

Through Credit Card Companies

Some credit card companies offer free credit scores as part of their service. Check if your provider offers this benefit.

Understanding Your Credit Score

Your credit score is calculated based on several factors. Understanding these can help you manage and improve your score:

- Payment History: A record of your on-time payments.

- Credit Utilization: The amount of credit you're using compared to your limit.

- Length of Credit History: The duration of your credit accounts.

- New Credit Inquiries: Frequent inquiries can lower your score.

- Types of Credit: A mix of credit types can positively impact your score.

Three Credit Scores

It's important to know that you have three credit scores, each from different credit bureaus: Equifax, Experian, and TransUnion. These scores might vary slightly due to differences in data collection.

FAQs About Running Your Credit Score

Will checking my credit score lower it?

No, checking your own credit score is considered a soft inquiry and does not affect your score.

How often should I run my credit score?

It's advisable to check your credit score at least once a year, but more frequent checks can help you stay informed and proactive about your financial health.

What should I do if I find an error on my credit report?

If you find an error, contact the credit bureau and the company that provided the information. They are required to investigate and correct inaccuracies.

Understanding and managing your credit score is crucial for maintaining financial stability and achieving your economic goals. Regularly running your credit score ensures you're on the right track.

How to get a copy of your credit report - Online by visiting AnnualCreditReport.com - By calling 1-877-322-8228 (TTY: 1-800-821-7232) - By ...

How are my credit report and credit score connected? - visit AnnualCreditReport.com - call toll-free 877-322-8228 or - complete the Annual Credit Report Request ...

Paying your loans on time - Not getting too close to your credit limit - Having a long credit history - Making sure your credit report doesn't have ...

![]()